Click on link to read the article.

I don't know what to make of this market.

My bottom fishing is not working and it is too tough to short at this area.

What's a person to do?

Monday, June 30, 2008

Running on Empty

Posted by

Unknown

at

6:50 PM

View Comments

![]()

![]()

Saturday, June 28, 2008

3 Percent Rule

I get questions now on then about the 3% rule. The rule applies to when you buy stock at a major trend lines (50,100,200) or possible bottom (bottom fishing). The rule also applies when you short at major trend lines or possible top. Risk only 3% loss based on the close. If you are down 3% on the close and the stock does not take you back above the 3% the day after and stay above it, then exit. I have found that this rule works at least 80% of the time which gives you a 4-1 reward versus risk.

For example, if you had shorted the DOW at 12,767.74. Using 3% means you should have covered at 12767.64x1.03=13,150.67 on the close. Guess what? It never got there.

If you were trying to catch a bottom in VLO, then you should have sold at 43.09 (44.42x.97)

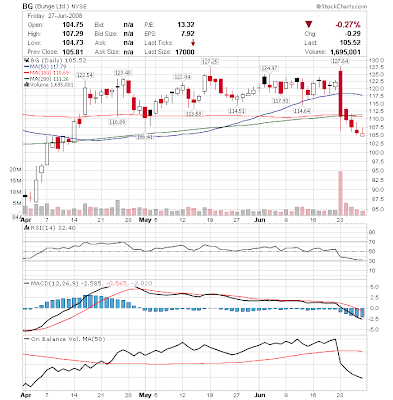

BG: If you bought at the 200sma, then you should have already exited the trade.

If you bought at 106, the you are still in until 102.82.

SNDK: If you bought, then you should still be holding. 19.54*.97=18.95 Note the stock hit 18.95 intraday but did not close below it. If you own this stock and it closes at 18.90. The next day opens up at 18.90. The stock is still a keeper unless it breaks 18.95. So you should set a stop loss there.

Posted by

Unknown

at

5:24 PM

View Comments

![]()

![]()

Thursday, June 26, 2008

Watch List

Don't forget the 3% rule.

Buy at the 200sma or 97% of the 200sma. Let it bounce first.

Low volume drop.

TNH

Posted by

Unknown

at

7:12 PM

View Comments

![]()

![]()

Some Charts

I like MOS but a little worried about the MACD cross down because it has run up so much.

Here is a little MOO for you.

FXP again - I think I am obsessed. Spike down had me worried but I am less worried today. Support levels are (81-82)/(77-78)(73-74

TWM - Is it going back to 90 or 60?

Still watching CIEN and SNDK. No buys yet.

Posted by

Unknown

at

6:05 AM

View Comments

![]()

![]()

Friday, June 20, 2008

See Doubles

Double Bottom Definition

JNPR Chart

SNDK Chart

Double Top Definition

USO Chart

Very close to a Double Top Breakout or Breakdown.

I am thinking Breakout.

FXP Chart

Update:

A Worldwide Bear Market

Another Update:

Do you see all the congestion on the P&F chart? It's like being stuck in a traffic jam. You won't get anywhere until you pass the jam.

More Update:

I was doing well by the 9th trade.

The 10th trade killed me, but the 11th trade made me.

See if you can beat my record with the same number of trades.

I went back to test my luck and made 2 more trades and WOW!

Posted by

Unknown

at

9:21 PM

View Comments

![]()

![]()

Wednesday, June 18, 2008

OMG again !!!

I first wrote about OMG here:

http://fade-me.blogspot.com/2008/05/build-not.html

Today, I found another write to confirm my thinking:

http://www.schaeffersresearch.com/commentary/observations.aspx?ID=85447&obspage=1

Keep an eye on it.

Posted by

Unknown

at

6:57 PM

View Comments

![]()

![]()

Monday, June 16, 2008

color on the candles

Q: On my pc when I view a candlestick chart, I notice that some candles on a down day ( close lower than the open ) are shaded in black. My normal color default for down days is red. Does the black candlestick represent something else ? Thank you.

A: Take two! ;-) Traditionally, candlesticks have not been different colors. If the close was less than the open, you get a filled candlestick and if the close was higher than the open, you get a hollow (white) candlestick. You can see this by turning off the "Colored Prices" option in our SharpCharts tool.

Coloring candlesticks is actually more complicated than you might first think and there are several places where people can get confused. One thing that can confuse people is that there is no such thing as a white candlestick - it is hollow, not white. That means that if you are viewing a candlestick chart with volume bars behind it (the default for SharpCharts), you may see a colored volume bar showing through a hollow candle. If you find that confusing, select "Separate" from the "Volume" dropdown just below the chart.

The next thing to keep in mind is that when the market is open, we add another candlestick on the right side of the chart based on the current intraday quote. Because that candle is still in the process of developing, we draw it on top of a yellow background. The yellow background will disappear when the final closing prices are recorded.

Finally, if you do enable the "Colored Prices" option for a SharpChart, here are the rules that we use:

* If the previous day's closing value is less than or equal to the closing value for the current day, draw the current day's candlestick in black.

* If the previous day's closing value is more than the closing value for the current day, draw the current day's candlestick in red.

Notice that these rules are subtly different from the rules for determining whether to draw a filled candlestick or a hollow candlestick. Those rules (stated in the first paragraph above) rely on the relationship of the opening price for the current day to the closing price of the current day. These subtle differences can lead to what I call "oxymoronic" candlesticks -- candles that are colored bullishly, but filled bearishly (i.e., a filled, black candle) or vice versa (i.e., a hollow red candle).

Source:

http://stockcharts.com/commentary/mailbag/mailbag20000809.html

Posted by

Unknown

at

6:32 PM

View Comments

![]()

![]()

Wednesday, June 11, 2008

4,8,21 ???

The objective is to find stocks that will cross before they do.

My stock screen sucks in that it does not do a very good job.

SMN: Keep an eye on it and buy on the cross above.

See how OBV is rising?

TWM crossed yesterday and continued up today.

Check out TB's site - http://traderbean.blogspot.com/2008/06/sohu-chart.html

And the chart below.

Posted by

Unknown

at

6:34 PM

View Comments

![]()

![]()

Monday, June 9, 2008

Bottom Fishing

Some times you catch one. Some times one gets away. I was trying to bottom fish FSLR again today.

My order did not get filled so I cancelled it and off to work I go.

Posted by

Unknown

at

7:04 AM

View Comments

![]()

![]()

Saturday, June 7, 2008

Kung Fu Panda

Watched Kung Fu Panda last night with my daugher and niece and nephew.

The movie has a memorable quote, "Yesterday is history, tomorrow is a mystery, today is a gift. That's why they call it 'the present.'"

Oh, and there is a secret. But I won't spoil it for you. If you really want to know then I will answer it for you in email.

Posted by

Unknown

at

7:34 AM

View Comments

![]()

![]()

Thursday, June 5, 2008

How to catch a falling knife

I posted the idea here at 08:51 AM and links to the chart.

http://beanieville.disqus.com/bidu_looks_good_to_go_higher/#comment-598949

Five minutes later at 08:56 AM

FSLR bought 242.50

4 pts stop. 10 pts profit.

http://beanieville.disqus.com/bidu_looks_good_to_go_higher/#comment-598987

I was lucky, but let's analyze the trade which has a reward/risk ratio of 2.5/1

Trust me, I wanted to buy FSLR at the open. But I keep telling myself, wait for it, wait for it, and don't chase it. FSLR breaking the previous close was not a good sign, but not breaking yesterday's low was a good sign. Notice the lows for the previous days - 251, 251.80. I figure FSLR might have a hard time closing above this.

And yes, I eat my own cooking.

Not all my trades are this perfect, but you get the idea.

Updated: This is an example of an order entry and not an actual trade.

Another udate: Why FSLR was a short at 262

Posted by

Unknown

at

6:21 PM

View Comments

![]()

![]()

Wednesday, June 4, 2008

Buy vs Short Stocks and Options

Just because the stock is down does not mean the put is down as well.

Here is proof as I have been obsessed with MA lately. I took profit from the day before and had thought that may be I left money on the table again seeing a 10pts drop in the morning. And yes, I did check the greek, but nothing explains it.

On another note, if you shorted GRMN at 50 and covered at 40, then you have a 20% gain. But if you bought at 40 and sold at 50, they you have a 25% gain. I am using 50 because that was the price where most pundits were suggesting to short the stock.

Hindsight is 20/20 (f8 copyrighted - lol)

Posted by

Unknown

at

6:19 AM

View Comments

![]()

![]()

Sunday, June 1, 2008

June could be crazy month for stocks

Click Title To Read

WOW! Beanie and I actually agree on something.

On Thursday, April 10, 2008, I wrote the following about GRMN in my post:

http://fade-me.blogspot.com/2008/04/frustration.html

Lastly, looking to buy and executing a buy are two different things. I have been looking to buy GRMN and I actually bought a small position in GRMN today at 46.25. Yes I know that GRMN can fall to 40, where the support is. However, I was willing to take the risk. It's a small position and even if GRMN goes all the way to ZERO, it would not hurt the portfolio. Obviously, I won't hold it to zero, but you get the point.

Buy straw hats in the winter.

If you read my posts, the same theme comes up over and over again, and that is 4,8,21.

On another subject, I have been working on Disaster Recovery Planning for the Oracle databases. Some of the same principles could be applied to a portfolio.

Posted by

Unknown

at

6:53 AM

View Comments

![]()

![]()