What's your style?

Singer?

Model?

Actress?

Is it good because it's above support?

Is it bad because it's below resistance?

Time vs Price. #EDZ b 51.10. Price would have taken me out, but Time kept me in. Do you give time for target to develop or do you give up?

Charts alone do not reveal trading style.

I see people follow trades not knowing the person's trading style. It's then followed up with question - Are you still holding the stock? Too late! Profit has been taken, or was already stopped out.

There's so many things involve: day trade, swing trade, long term trade, capital risk, etc..

Before you follow someone into a trade, know your style and know the trader's style.

Saturday, May 29, 2010

style

Posted by

Unknown

at

5:59 AM

View Comments

![]()

![]()

Monday, May 24, 2010

Ways to Invest in Gold

Since the start of this current economic downturn many people have touted gold as a safe place to put your money. Most experts say that not only will you not lose a penny of your investment, that you will actually make a decent return. Gold has always been used as a safe place to put your money in tougher economic times. However buying and storing actual gold bars is quite expensive. Yes, gold bars will increase in price, but you would still have to pay to store them and a security force to guard them. So this might not be the best way to invest in gold. Luckily there are futures contracts that investors can buy that will give them a stake at a future delivery of gold. If the future price goes up you make money without taking delivery of the gold. You don’t have to take delivery of gold because you sell that contract before the delivery date, or you roll that contract over into the next month. A futures contract might require the investor to buy more product than they are comfortable buying. If the investor is looking only to play the gold market with a small account the best way would to buy gold related stocks and companies. There are many gold Exchange Traded Funds that will follow the price of gold. There are also gold mining companies which stocks correlate to that of the price of gold. A few of them being Barrack Gold Corp, ticker (ABX) and another company based out of Peru called Compania Mina Buenaventura, ticker (BVN).

Mining companies are a good way for the average investor to play the gold market without buying the actual gold itself. Any novice trader with a brokerage account can buy and sell these companies when they believe that the price of gold will go higher or if the price will go lower. The profits of these companies come from selling the metals they mine; naturally if the price goes up on any commodity they sell they will have greater revenue. Higher revenue is always a good sign that the company is doing well. If ABX and BVN are selling the gold they extract at high prices their earning per share will guide higher and the stock price will most likely follow. Buying stock in these companies allows you to play the gold market without being heavily invested in one particular instrument. Most brokers will now accept stock order for under a hundred shares, so you will be able to invest less if you are not ready to invest all the money you have set aside.

It is always safe to diversify your portfolio and not put all your money into any one company. It is also safer to spread out your equity positions among the different sectors in the market. Gold is a precious metal that is known to be volatile over the years. If you are investing in a company that extracts gold and other commodities be sure you look daily at the actual commodities price. If the prices of commodities start to fall the stock of the company that mines gold will also fall. This could mean that you sell your stock and wait on the sidelines. You can also take short positions in gold miners if you think gold prices will fall. Shorting allows you to take advantage of the downside risk that gold has. Sometimes when the price has run up substantially over the past few days or weeks it is due for a correction. Using foreign exchange indicators will also hint at which direction gold and gold mining companies will head. There are many free forex indicators available online for you to study over. These indicators in the currency markets may be able to tell you where the price of gold is headed. As an example if the U.S Dollar starts to strengthen, than commodities prices including precious metals tend to move lower. Using simple moving averages as a Forex indicator, investors can get ahead of the trade by seeing when the shorter moving average crosses over the longer moving average. This will signal a strengthening of the dollar and a signal to get out of mining companies.

Through useful negotiations, this article was brought to you by www.forexindicators.net

Posted by

Unknown

at

6:32 PM

View Comments

![]()

![]()

Sunday, May 23, 2010

aperture

There are images with blur background.

I am not saying it's right or wrong.

But what are you focusing on?

Posted by

Unknown

at

7:32 AM

View Comments

![]()

![]()

Saturday, May 22, 2010

opportunistic

Before I start my rant, let's distract you with something beautiful.

Lately, I keep hearing - being early is the same as being wrong.

Is being late any better or is it better late than never?

HINDSIGHT MAKES EVERYONE SMARTER!!!

How many times have you missed a filled by $0.01, $0.10, $1.00, or 1%, etc...?

What about opportunistic cost!

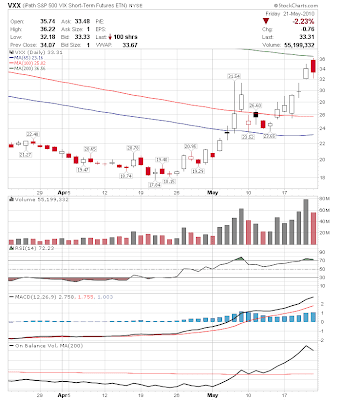

Here's a search on my tweets showing I was looking to short VIX / VXX

If you look at the chart(click image for larger size), ma200 = 36.56

36.56*0.99=36.1944

If I weren't too concerned about being early to being precise, then my short order would have been filled. Too often, I try to get the absolute best possible price which leads to missed opportunity. You only know you can buy it lower or sell it higher in hindsight. Before that, it's all an educated guess.

Note: There's a fallacy in this argument and there's a flaw in the data

See if you can find it.

But you get the point.

Posted by

Unknown

at

4:31 AM

View Comments

![]()

![]()

Sunday, May 16, 2010

golden cross

As promised, keeping track of the golden cross.

We are pretty close to a year; hence, there will not be any more updates.

Don't get axed in the market.

Posted by

Unknown

at

10:15 AM

View Comments

![]()

![]()

Sunday, May 9, 2010

focus

Where's your focus and What's your focus?

I wanted to write this earlier but was a little lazy.

Don't lose your focus, especially on the day when the DOW plunged 1000 points.

Don't let it distract you because that's exactly what happened to me.

Now, a little more about the turtle system. The system is based on trend.

Pull up a 2m10d chart. Is the current price higher or lower?

I know this is over simplification; however, shouldn't things be kept simple?

In the last 55 days, CEDC made 7 new highs and 3 new lows.

In the last 55 days, VTIV made 12 new highs and 0 new lows.

Posted by

Unknown

at

6:54 AM

View Comments

![]()

![]()

Saturday, May 1, 2010

reason

Things happen for a reason.

If you think you are smarter than the market, think again.

I confess that I do this, but it's wrong and a bad habit.

Stocks move up or down for a reason.

The reason may not be known to you but there is a reason.

Let's evaluate the counter turtle trade on GMCR

I first posted GMCR counter trade on April 21.

For those who are on my email list, check your email.

Turtle trade was to short and cover at 90.57.

I got excited on the bounce and bummed that I had missed the bounce.

Of course, you could have played the bounce, but the true play was to short.

Also, all of this is hindsight.

GS is another example of going against the trend (bought 147.50/sold 144.36)

The plan was to short just below 200sma, which I obviously missed.

I chose the above image for a reason.

I created this post for a reason too.

Posted by

Unknown

at

5:37 AM

View Comments

![]()

![]()