I get questions now on then about the 3% rule. The rule applies to when you buy stock at a major trend lines (50,100,200) or possible bottom (bottom fishing). The rule also applies when you short at major trend lines or possible top. Risk only 3% loss based on the close. If you are down 3% on the close and the stock does not take you back above the 3% the day after and stay above it, then exit. I have found that this rule works at least 80% of the time which gives you a 4-1 reward versus risk.

For example, if you had shorted the DOW at 12,767.74. Using 3% means you should have covered at 12767.64x1.03=13,150.67 on the close. Guess what? It never got there.

If you were trying to catch a bottom in VLO, then you should have sold at 43.09 (44.42x.97)

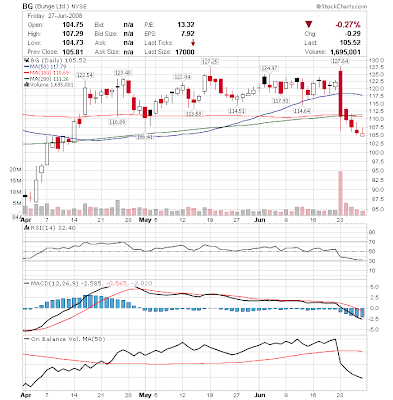

BG: If you bought at the 200sma, then you should have already exited the trade.

If you bought at 106, the you are still in until 102.82.

SNDK: If you bought, then you should still be holding. 19.54*.97=18.95 Note the stock hit 18.95 intraday but did not close below it. If you own this stock and it closes at 18.90. The next day opens up at 18.90. The stock is still a keeper unless it breaks 18.95. So you should set a stop loss there.

Saturday, June 28, 2008

3 Percent Rule

Posted by

Unknown

at

5:24 PM

![]()

![]()