I apologize for being bad and neglecting the blog; however, it does not mean I am not thankful to all of you. Wishing you and your family a wonderful holiday and all all trades be profitable.

Wednesday, December 21, 2011

Happy Holidays 2011

Posted by

Unknown

at

6:32 AM

View Comments

![]()

![]()

Tuesday, October 18, 2011

Not Best, But Right

I came across this technical blog talking about Right Practice

The same Right Practice applies to trading as well.

I see people asking on the streams, what's the best technical indicator, what's the best trading strategies, what's the best time frame to trade, etc...

The answer to all those questions is, "It depends!"

Stop looking for what's best for someone else, and start looking for what's right for you.

Posted by

Unknown

at

5:10 PM

View Comments

![]()

![]()

Monday, October 3, 2011

Death Cross

Back in the days, there was a huge debate on golden cross which you can find >>here.

On the opposite end, here is the >>SPX death cross which seems to be ignored?

Take a look at the big picture to see where the supports are at.

Bears were late and it's possible that bulls will be late as well.

Look at how many shorts NFLX killed only to drop from 304 to 107 in 3 months.

Posted by

Unknown

at

6:03 PM

View Comments

![]()

![]()

Sunday, August 7, 2011

Shopping List

Buy point for some stocks seen on the stream.

POT 50/40

SOHU 65/60

VALE 19

RAX 30/21

CLF 63

08/09 POT bought some for ROTH 51.88 - feeling foolish

Posted by

Unknown

at

4:10 PM

View Comments

![]()

![]()

Friday, July 22, 2011

Flexible Conflict

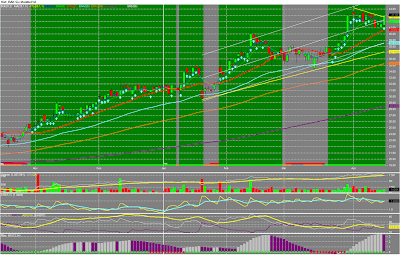

In my previous post, I wrote about trend trading using the 200ma.

Here I want to show you charts of BVN, the love the left without me.

P&F Chart shows bad price objective, but notice the reversal.

Stock is below 200ma which normally means avoid.

But short term indicator was great and missed opportunity.

What do you see in the above chart?

If you are a frequent reader, then you know my sayings.

What happened? How did I lose track of this stock? I failed to differentiate between short term and long term trend and lost focus. While long term trend can be down, short term trend can turn up.

Since you made it this far, here's something for you to enjoy,

That's Nha Trang Beach in Vietnam.

Posted by

Unknown

at

5:31 AM

View Comments

![]()

![]()

Monday, July 11, 2011

Trend Trading

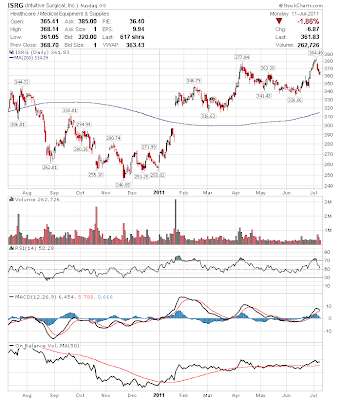

Is trend trading that easy?

BUY when 200sma slope is positive and stock crosses above 200sma.

SELL when 200sma slope is positive and stock crosses above 200sma.

CAREFUL when 200sma slope is negative.

I have not back tested the strategy; hence, I don't know how effective it is.

If it was that easy, then why most money managers cannot even beat the index.

Easy in hindsight, isn't it?

Here are some 1year charts for you to look at.

Posted by

Unknown

at

6:05 PM

View Comments

![]()

![]()

Wednesday, June 15, 2011

Trading Ideas

This is not a trick just to get you here. There isn't any.

Trading ideas are very different from trading executions.

A poorly executed idea (even if it was a good idea) can result in poor returns.

There are lots of ideas out there, but do the ideas complement or supplement yours?

Don't tell me you haven't taken someone great ideas and it turned into disaster!

Ideas are starting points no more no less.

And don't forget, too many chefs spoil the broth.

Posted by

Unknown

at

5:03 AM

View Comments

![]()

![]()

Monday, June 6, 2011

June Gloom

Some gloomy holdings carried forward from May; however, that smile is beautiful.

>>AKAM

04/18 B@39.90 #FC

>>LRCX

05/04 B@48.50 #HV

>>JPM

05/31 B@43.25 #utma

>>MOBI

06/24 B@7.80

>>MOTR

06/24 B@8.80

>>PBR

06/29 B@32.80 #ESA

CLOSED Positions:

>>TZOO

06/28 B@61.75 #ROTH

06/29 S@65.26

http://twitter.com/#!/fortune8/status/86116415538610176

>>CLF

06/23 B@82.50 stop below 200sma

06/24 S@86.50

>>BVN

06/07 B@35.90 for trade #ROTH

06/14-06/16 S@37.60,37.90

>>SLV

06/16 B@34.50 auto trade #IB

06/27 S@32.80 (For same for not taking profit)

Posted by

Unknown

at

5:10 PM

View Comments

![]()

![]()

Tuesday, May 31, 2011

Cost of Laziness

I wanted to post this yesterday, but I was too lazy.

How does laziness affect your trading?

First, you get ideas from the stream without any validations.

You make the trade with 3% profit, but other person made 30%.

Sure, you are happy making 3% profit, but you missed out - opportunity cost.

Worse, you make the trade the stock drops 10+% and you now have a loss.

The other person already sold with 1% loss.

Now, you are left holding the bag.

You were too lazy to do any research, ask any question, do any validation.

I never understood how someone can have 1% loss and a 10%+ profit in this volatile market, but that's a topic for another day.

Another example of laziness which I encountered yesterday has to do with keeping financial data on the cloud. Here is a brief description of the product - a personal finance security service that alerts you to unwanted and unauthorized transactions on your credit card and debit card bills.

First, if your credit card does not have any fraud detection algorithm, then it's time to get a new one.

Second, if you are seriously that stupid and/or that lazy where you don't know about unwanted or unauthorized charges to your account, then you deserve to get robbed.

Too lazy to exercise? How much is that costing you?

Find out how much it's costing you to be lazy.

Posted by

Unknown

at

5:05 PM

View Comments

![]()

![]()

Sunday, May 1, 2011

May Day

AKAM

04/18 B@39.90 #FC

>>AKAM

LRCX

05/04 B@48.50 #HV

>>LRCX

JPM

05/31 B@43.25 #utma

>>JPM

SLV

05/05 B@34 #IB

05/06 SS@0.25 May06 #IB

05/09 S@36 50% holding

05/10 S@37.40 50% holding

05/10 S@37.475 all remaining

ENTR

05/11 S@9.40, 04/21 B@8.40 #UTMA

TZOO

05/19 S@69.830/69.650, 05/19 B@69 #ROTH

ABX

05/26 S@47.20, 05/18 B@45.30 #UTMA

SLV

06/01 S@35.90, 05/27 B@37.10 #HV (stop under 36)

AKS

06/06 S@14.90, 05/23 B@14.20 #HV

Posted by

Unknown

at

2:35 PM

View Comments

![]()

![]()

Sunday, April 17, 2011

Best Use of StockTwits 50

First, I would like to thank the ST50 team for implementing my suggestions.

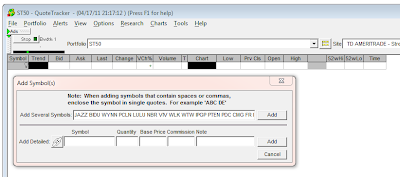

If you go to the StockTwits 50, April 16, then you will see the information in the image below.

Click on St50 April 16 to retrieve the list of stock symbols.

Use Quote Tracker to Create Portfolio and Add Symbols to List

Here's the result.

Chart created base on your configuration and layout.

Posted by

Unknown

at

6:15 PM

View Comments

![]()

![]()

Monday, March 28, 2011

April

$TSL

02/28 B@27.80 #ROTH

03/28 Sold APR29C $1

$AKAM

04/18 B@39.90 #FC

$ENTR

04/21 B@8.40 #UTMA

$FSLR

04/29 $FSLR S@142.62, 04/27 B@137.90 #IB

$FNSR

03/29 S@20.20, 03/28 B@23.60 #ROLL (Hope this does not haunt me)

$ANR

http://twitter.com/fortune8/status/49829451340595200

03/30 S@59.00, 03/21 B@55.850 #ENTRIQ

$HMIN

04/04 Cover @41.65, 04/04 Short @42.70 #SCHW

$CREE

04/05 S@45.00, 04/05 B@42.30 #SCHW

$HMIN

04/06 Cover @43.348 , 04/06 Short @42.90 #SCHW

New Rule: No Double Dipping.

$CHL

04/08 S@47.00, 02/17 B@47.50 #ENTRIQ

$FXI

04/08 S@45.99, 02/17 B@42.39 #ROTH

$BVN

04/08 S@44.60, 03/29 started position at $41.900 #ROLL

$SDS

04/12 S@22.151, 04/11 B@21.72 #SCHW

Wrong price posted in comments.

$RVBD

04/16 S@35.46, 04/07 B@33.45 #ENT

$MRVL

04/18 S@15.45, 04/07 B@16.2392 #FC

$MOS

04/20 S@76.01 B@74.80 #IB

$AAPL

04/21 CS@349.54, 04/21 SS@354.06 #IB

04/26 CS@352.75, 04/26 SS@351.85 #IB

Posted by

Unknown

at

9:05 PM

View Comments

![]()

![]()

Saturday, March 5, 2011

March Lesson

I love models who smile.

Last month, I took a bath in CREE. The bad trade turned worse because I was too stubborn to sell it. Going through my thoughts, I was thinking buying some puts for insurance but did not execute. Going forward, if holding through earnings buy puts.

Oh Shit! This is another one I need to dump as well.

A few bad losses can dent into profits already made.

From now on, no losses greater than 5% !!!

$MOTR

03/07 S@13.89, 02/07 B@21.55 #ENTRIQ

03/09 S@13.50, 02/09 B@18.45 #SCHW

$ABAT

03/07 S@3.74, 02/17 B@3.80 #HV

$REE

03/09 S@11.2501, 03/04 B@11.70 #FC

$AKAM

03/10 LOSS S@35.98, 03/03 B@38.55 #SCHW

$BVN

03/16 S@43.10, 03/15 B@41.700 #ROTH

03/21 S@43.2601 03/18 B@41.99 #FC

$VMW

03/22 S@73.233, 03/22 B@77.70 #SCHW (stops too tight)

$CHL

02/17 B@47.50 #ENTRIQ

$FXI

02/17 B@42.39 #ROTH

http://twitter.com/fortune8/status/49829451340595200

$ANR

03/21 B@55.850 #ENTRIQ

Posted by

Unknown

at

5:39 AM

View Comments

![]()

![]()

Tuesday, February 1, 2011

Happy Tet

Trang Nhung (I cannot believe she is Viet)

$CREE

01/13 B@$66.090 #ROTH

03/04 S@49.90

Bad CREE trade plus stubborn made it worse.

$MOTR

02/07 B@21.55 #ENTRIQ

02/09 B@18.45 #SCHW

$BVN

02/02 S@44.38, 01/27 B@41.50 #UTMA (phantom trade)

03/03 S@46.50 02/15 B@41.6799 #FC

$FXI

02/17 B@42.39 #ROTH

$CHL

02/17 B@47.50 #ENTRIQ

$ABAT

02/17 B@3.80 #HV

Posted by

Unknown

at

8:15 PM

View Comments

![]()

![]()