Do you know the two resistances for the DOW?

If not, then I suggest you dig them up and memorize them.

Can some one memorize the ones for SPX and NAZ?

Use any bounce as a chance to hedge your portfolio,

Monday, March 31, 2008

Beating a dead horse

Posted by

Unknown

at

9:18 PM

View Comments

![]()

![]()

Sunday, March 30, 2008

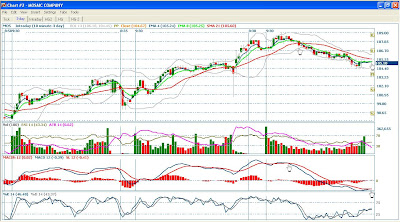

Agriculture Earnings Duel: Mosaic vs. Monsanto (MOS, MON, MOO)

Click on the title to read the story.

I am not going to try to predict the direction of the market.

Instead, I will just use TA to trade and go with the flow.

MON / MOS : short or buy?

Watch for a trend to develop and play the trend.

Don't try to guess what the market will be doing.

Update:

Unless you are 100% cash at the end of the day, you always need to keep a little hedge.

On Tuesday, March 25, 2008, I wrote the following

here

Notice that I did nibble on some TWM, QID, SKF today. Why?

I am anticipating a bad GDP report on Thursday. If I am wrong, then I will sell the positions. And if I am right, then I am already ahead of the game.

Posted by

Unknown

at

8:23 AM

View Comments

![]()

![]()

Saturday, March 29, 2008

Thursday, March 27, 2008

Getting Attention

Solars definitely have been getting attention.

This means traders will now gravitate towards the sector.

Good for trading.

It's best to buy the pullback versus chasing it up.

Who says that this market is too volatile to trade?

That person does not have the right stock and the right setup or just don't know how to trade this market.

BUY: 4ema and/or 8ema cross above 21sma.

SELL: 4ema and/or 8ema cross below 21sma.

I use 2min and 5 min charts.

The 2min gives an earlier signal but has a lot of noise.

Do you see how the MACD provides an early signal and then confirmed by moving averages.

==================================================

JOIN ME?

It's hard to watch a lot of stocks. But if you are willing to join me and help me, then we each can watch a stock or two. You will need real time charting. Want to make some money? What say you?

==================================================

I posted buy SRS here

Where do you think I bought it on the chart?

Don't cheat, figure out the answer and then check your answer.

Do you see where the noise is at?

Posted by

Unknown

at

7:29 PM

View Comments

![]()

![]()

Wednesday, March 26, 2008

Penny-Wise, Pound-Foolish

Penny-Wise, Pound-Foolish ( cautious with small amounts of money, but careless with larger amounts ... )

People hold stocks with 50% loss and sell stock with 5% gain.

You have to break the habit if you truly want to make money.

Which stocks are down 50%?

How about solars and VMW?

Math question -- if you have 50% loss in a postion, how much gain do you need to break even.

Posted by

Unknown

at

7:42 PM

View Comments

![]()

![]()

Tuesday, March 25, 2008

Trend

Trend is the general direction in which something tends to move.

Trend by itself can be ambiguous without a timeframe.

The intermediate and long term trend for the market is down.

There's another ambiguity - intermediate and long-term (for what timeframe?).

I am sorry if I like tend to like details versus lack of details.

You can not ignore that the market trend for the last few days have been up.

Don’t fight the trend as I have been trying to short MA.

I am revenge trading again.

I will get this right eventually, but how much will it cost me?

It’s very difficult to call market tops and bottoms. Think about it, how many pundits were saying that the market will retest the lows just a few weeks ago. Some indexes did and some didn’t. So were they right or wrong?

Notice that I did nibble on some TWM, QID, SKF today. Why?

I am anticipating a bad GDP report on Thursday. If I am wrong, then I will sell the positions. And if I am right, then I am already ahead of the game.

Posted by

Unknown

at

6:21 PM

View Comments

![]()

![]()

Monday, March 24, 2008

Ceiling

Nothing to write home about except that it was a very good day.

ags had a nice rally but looked weak heading into the close.

I will definitely look for a reversal and will jump in.

I will still continue to trade following the technicals and the trend.

The trend in solars oontinued to move up today.

Nothing to hold but something to trade.

Significant Numbers To Watch

DJIA:

11634-Support, the 1/22/08 low

12767-Resistance, the 02/01/08 high

12343-50-day simple moving average

13195-200-day simple moving average

S&P 500:

1256-Support, the 03/17/08 low

1396-Resistance, the 02/01/08 high

1346-50-day simple moving average

1456-200-day simple moving average

NASDAQ:

2155-Support, the 3/17/08 low

2419-Resistance, the 02/01/08 high

2322-50-day simple moving average

2564-200-day simple moving average

Posted by

Unknown

at

7:28 PM

View Comments

![]()

![]()

Thursday, March 20, 2008

What The Hell !!!

When everyone has given up in this market, that's when the bottom is in.

The volatility is great for making money if you don't fight the trend or try to out smart the market. You will get hurt trying to time the market. You will get hurt trying to find a bottom. You will get hurt trying to find a top.

If you do those things, then expect to get hurt. Even I am guilty of it by shorting MA on this run up.

Didn't I tell you today was going to be volatile because of option expiration?

If you don't already know that, then you seriously need to take trading 101 or serious help.

Let's review everything.

Correction in financials, solars, oil, ags, gold, etc...

Every sector has been affected and no sectors were immuned.

Expect the unexpected !!!

Stop quiting and learn to use the trend as your friend.

Happy Easter.

Updates:

The reason you are losing in this market is because you are fighting the trend.

You let the noise around you affect your trading,

Hinsight is 20/20 (copyrighted)

But look at here LEH should have been bought for a nice gain.

Posted by

Unknown

at

3:57 PM

View Comments

![]()

![]()

Wednesday, March 19, 2008

No Pump and Dump Hypocrites Allowed

You know I love ags; however, I am not going to pump.

The trend is your friend.

If you really want ags, then just nibble (20%) in case it continues to decline.

Here is the intra-day chart for MOS.

Do you see where you should have shorted?

Do you see where I bought and then got stopped out?

Here is the intra-day chart for the VIX.

I was not around to take advantage of the action.

But then you know I was already short from yesterday.

Here is a 5 day VIX chart.

Do you see where you should have gone short?

Doesn't that look easy?

It's always easy to look at a chart after the fact and get the big picture. However, it's a little harder to do it live.

Hindsight is 20/20 (copyrighted)

I will post links in the comments section and you can fill in the favorite ags.

Posted by

Unknown

at

6:40 PM

View Comments

![]()

![]()

Monday, March 17, 2008

Less Than Perfect Execution

I am sharing some charts with you for stocks that I have BOUGHT and SHORTED today.

BUY when 4ema cross above 21sma and SHORT when 4ema cross below 21sma.

Shorted MA 204 and covered 203. What's wrong with that?

Bought POT at 154.55. What's wrong with that?

Holding POT overnight.

I need to focus on quality and not quantity, and not to over commit capital.

Posted by

Unknown

at

3:07 PM

View Comments

![]()

![]()

Sunday, March 16, 2008

Watch the VIX

I know some of you will be fading the gap.

While that may be a good strategy, you don't know if the gap will continue to trade down.

You want to go with the trend and not against it.

See comments for P&F charts for the VIX.

Posted by

Unknown

at

7:35 PM

View Comments

![]()

![]()

Hot Sectors

Closed minded. I think most of us love to stick to a group of stocks and are not willing to venture. Hands raise. However, even in a down market there are still sectors and stocks within the sector that go up.

The industrials were up 2.64% in the last five days.

Within this sector Consstruction & Farm Machinery and Heavy Trucks are up 26.64%.

Posted by

Unknown

at

7:26 AM

View Comments

![]()

![]()

Thursday, March 13, 2008

I QUIT TOO !!!

Gotcha !!!

I am not quiting just yet, but I will have less and less time to trade. Hence, I will focus on building my long term portfolio.

Don't miss the boat. I am talking about LDK. If I bought at 30, have I missed the boat? What boat are people talking about here? I am not at break even yet !!!

Today I made fun of beanie for shorting FSLR. Actually, I was not better because I had shorted MA. I tried to force the trade because I had made a nice profit from the short position from the prior day. I was lucky and I was greedy.

Risk versus reward. Why would you make a trade if the reward was is not greater than the risk? Why would you make a trade if you don't know where the exit point is?

Today I bought FSLR at 196 with a stop loss at 193. I was willing to take a 3 pts loss on the trade. Yet, when FSLR ran to 197, I sold because I was nervous. Does that make sense to you? I was willing to take a 3 pts loss for a 1 pt profit? Now what kind of idiot would make that kind of trade. DON'T ANSWER THAT !!!

Have a strategy and stick to the strategy. I know I have said this over and over many times. Still emotions just get in the way some times.

UPDATE

Here is the chart for FSLR. I use 4ema, 8ema, 21sma. When 4ema and 8ema cross above 21sma. then it is time to buy.

I posted buy at 196 and had no reasons to sell until 4ema and 8ema cross below 21ema.

The 5 minute charts give you a smoother chart and less noise.

See the first hand where MACD cross above? Then the second hand where ema cross above as well. See the slope started to turn from negative to positive?

Posted by

Unknown

at

8:40 PM

View Comments

![]()

![]()

Going Fishing

IF THE STOCKS DON'T BOUNCE, THEN DON'T BUY IT.

Do this as an experiment.

Take a knife outside and drop it on the cement.

Do you see how it bounces serveral times before coming to rest?

All the supports numbers are not concrete; thefore, it might be off by 3% delta I have been talking about all along.

I am looking at good fundamental companies with low PE.

DRYS at 57 and VLO at 48

Posted by

Unknown

at

6:24 AM

View Comments

![]()

![]()

Tuesday, March 11, 2008

2008Mar12

Understand Newton's Law.

Newton's First Law of Motion:

I. Every object in a state of uniform motion tends to remain in that state of motion unless an external force is applied to it.

Newton's Third Law of Motion:

III. For every action there is an equal and opposite reaction.

Can you see how this apply to trading?

Posted by

Unknown

at

8:31 PM

View Comments

![]()

![]()

Monday, March 10, 2008

Revenge Trading

Thanks Gio for chewing me out on revenge trading.

Some times, you just need an outsider to slap you in the face to wake you up.

Also there were news on Chinese Polysilicon Company Dumping Toxic Waste.

Posted by

Unknown

at

8:57 PM

View Comments

![]()

![]()

Sunday, March 9, 2008

2008Mar10

Next Week

The January count for wholesale inventories will be published on Monday. The latest look at the nation's trade balance is due out on Tuesday. An update on the federal budget deficit and the weekly figures for crude oil and gasoline inventories are scheduled for Wednesday. New numbers for retail sales, import and export prices, business inventories and weekly initial jobless claims will be released on Thursday. The week's flow of economic data concludes on Friday with reports on the Consumer Price Index (CPI) and the University of Michigan's Consumer Sentiment Index.

Significant Numbers To Watch

DJIA:

11634-Support, the 1/22/08 low

12767-Resistance, the 02/01/08 high

12551-50-day simple moving average

13263-200-day simple moving average

S&P 500:

1270-Support, the 1/22/08 low

1396-Resistance, the 02/01/08 high

1375-50-day simple moving average

1466-200-day simple moving average

NASDAQ:

2202-Support, the 1/23/08 low

2419-Resistance, the 02/01/08 high

2395-50-day simple moving average

2580-200-day simple moving average

Posted by

Unknown

at

9:42 PM

View Comments

![]()

![]()

Mistakes, Mistakes, and More Mistakes

Charles E. Kirk from The Kirk Report have said that trading is a game of mistakes and not perfections. There is some truth in that. I know a person who turned 25k into 2 million and lost it all. Then what about Jesse Livermore who commited suicide? You get the drift. And you don't want to be a Jesse Livermore, do you?

I have said that in a down market, do not chase stocks. Let it come to you. I know that it is best to invest for the long term. However, losing 25% of the position in the short term is hard to stomach. Even worse is losing 50% of the position. This is evident with a lot of momentum stocks, e.g. CROX, LDK, STV, STP, etc... and the list goes on.

In my country there is a saying that goes something like, "Light is bright and ink is dark." All that means is you hang out with the bulls in a bull market and you hang out with the bears in a bear market. If you hang out with the wrong animal, then you can get killed.

The problem with following someone's recommendation is that you don't know when the person sells. The person could have sold long time ago and you are left holding the bag. You have to be careful and know when you need to take profit or take a loss. Don't get stuck in the hold and hope mode.

Lastly, don't fight the tape. I know LDK is a great stock. Answer me this, if the stock was so great, then why did it fall from 60+ in Dec 2007 to a new 52wk low now? Why is everyone selling the stock? Wasn't Enron a great stock?

Trust me, I have got pulled into the solar euphoria as well. I think all the good money have been made and it might be hard money going forward. I got sucked into buying STP at 38, bought Apr15c for JASO, bough FSLR at 198, etc...

You have to leave out the emotion when investing. It's easier said than done. This is why Winace is so harse about his blog because he does not want anyone to post that is in disagreement and causes him to lose focus. As for me, I like to entertain different ideas and different point of views.

That's all folks.

Posted by

Unknown

at

2:16 PM

View Comments

![]()

![]()

Friday, March 7, 2008

Solar Eclipse

Descending Tripple Bottom Breakdown is a bad thing.

Look at the P&F chart for LDK (in comments section)

Notice that LDK broke down on 27-Feb-2008 and continued down.

This means don't buy the stock.

FSLR looks bad as well. Lower highs and lower lows.

Will be tough to hold if it breaks 194.

Other solar stocks with same pattern breakdown: SPWR, STP, FSLR.

Won't you buy more?

Disclaimer: hindsight is 20/20

Posted by

Unknown

at

5:07 PM

View Comments

![]()

![]()

2008Mar07

Speechless. It's difficult to trade if you are not available during market hours. I definitely did not see the market drop coming.

The numbers were bad as expected. Futures are slightly up, but hang on.

Still building my IRA portfolio.

Posted by

Unknown

at

5:37 AM

View Comments

![]()

![]()

Wednesday, March 5, 2008

2008Mar06

In hindsight, Tuesday was an opportunity to buy, especially when the market had rally in the last 30 minutes. This market has been beaten up. And it may test lower lows. However, the bad news are out and there may be more to come.

From what I understsand, no one wants to miss an opportunity to invest at such a cheap price. Note that I say invest which means more than 1 year. Not buy today and sell tomorrow.

Look at TLT because it has been falling. With interest cut, people are not going to renew the CD's at 1%. The money can better be invested in the stock market.

Think about it.

Build a core position and when the market moves toward resistance, buy 2x inverse ETF to hedge your portfolio.

DOW resistance = 12,800

Updated:

Z had asked me how you can make 800% on TIE. Here is the probabilty calculator. The question you have to ask yourself is, "Will TIE see 25 by April expiration?"

See comment section for links to chart.

Posted by

Unknown

at

8:22 PM

View Comments

![]()

![]()

Citibank

Warning: RANT.

I AM SHORT CITIGROUP ! (Just not the stock, okay?)

They would not give me a courtesy on the late fee, when I was 2 days late because I had a brain fart of some sort.

DRYS purchased yesterday is working today. I have sold Mar80c against the shares for some down side protection. For now I will be happy getting 80 for DRYS, but by that time, I will be upset because the stock will probably be at 90 - LOL

Exited FSLR at 202 just before the close yesterday and you know the story.

Bought some MON today - stock is hovering 50ema

Posted by

Unknown

at

7:10 AM

View Comments

![]()

![]()

Monday, March 3, 2008

2008Mar04

Not sure what tomorrow will bring, but here are the numbers.

Significant Numbers To Watch

DJIA:

11634-Support, the 1/22/08 low

12767-Resistance, the 02/01/08 high

12656-50-day simple moving average

13295-200-day simple moving average

S&P 500:

1270-Support, the 1/22/08 low

1396-Resistance, the 02/01/08 high

1388-50-day simple moving average

1471-200-day simple moving average

NASDAQ:

2202-Support, the 1/23/08 low

2419-Resistance, the 02/01/08 high

2431-50-day simple moving average

2588-200-day simple moving average

Posted by

Unknown

at

7:40 PM

View Comments

![]()

![]()