Before I start my rant, let's distract you with something beautiful.

Lately, I keep hearing - being early is the same as being wrong.

Is being late any better or is it better late than never?

HINDSIGHT MAKES EVERYONE SMARTER!!!

How many times have you missed a filled by $0.01, $0.10, $1.00, or 1%, etc...?

What about opportunistic cost!

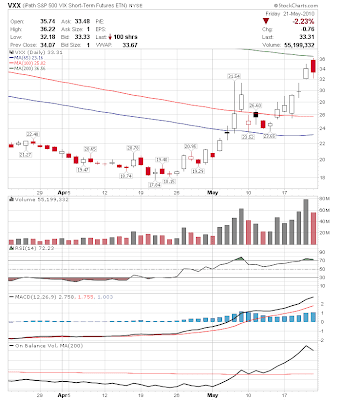

Here's a search on my tweets showing I was looking to short VIX / VXX

If you look at the chart(click image for larger size), ma200 = 36.56

36.56*0.99=36.1944

If I weren't too concerned about being early to being precise, then my short order would have been filled. Too often, I try to get the absolute best possible price which leads to missed opportunity. You only know you can buy it lower or sell it higher in hindsight. Before that, it's all an educated guess.

Note: There's a fallacy in this argument and there's a flaw in the data

See if you can find it.

But you get the point.

Saturday, May 22, 2010

opportunistic

Posted by

Unknown

at

4:31 AM

![]()

![]()