Wednesday, December 31, 2008

Monday, December 29, 2008

Wednesday, December 24, 2008

Happy Holidays Everyone!

Naughty or nice, bulls or bears, friends or enemies, I wish you a joyous holiday and a prosperous New Year.

If you don't see it, then click on the present to see the giffs inside.

Posted by

Unknown

at

6:44 AM

View Comments

![]()

![]()

Tuesday, December 23, 2008

BeWare of Experts

In my profession, I have learned to question authority and also to be cautious of the so called "expert". I went to technical training provided by an "expert". Trust me when I say I don't know a lot. However, when I knew 80% of the training materials provided by the "expert", I realize it was a waste of money.

The same also applies to the stock market. Too many experts want to take your money and teach you how to trade. Honestly, the best way to learn is to teach your self, to make mistakes, and to learn from the mistakes. It also doesn't hurt to have a mentor, one who wants to help versus hinder you.

I came across an intereresting read >If you could meet one person...

Today, I saw too many individuals who were clueless about the distribution on 2x ETFs. And these individuals are the ones who want to show you how to trade for a fee. I am not going to name any names, but I am sure they know who they are. If I have offended you, then it's probably you that I am talking about.

Lastly, I am not here to prove anything. I am here to disprove. I am the yang to the ying and the counter example to the example.

Posted by

Unknown

at

7:15 PM

View Comments

![]()

![]()

Friday, December 19, 2008

Twitter Humor

Replace the whale image with the fox image.

Are users that happy to know that twitter is down?

They would be if they know Megan is working on it.

Posted by

Unknown

at

5:29 AM

View Comments

![]()

![]()

Thursday, December 18, 2008

EBS Short

>EBS P&F

>EBS Candle

3x a charm? It either break out or break down. I am going to risk 1 pt that it doesn't for 2 pts gain on the downside. That's 2/1 reward versus risk or more.

Changing stop to 26.10

Posted by

Unknown

at

7:43 PM

View Comments

![]()

![]()

Wednesday, December 17, 2008

Against All Odds

Normally, it is bad to go against the trend. But do you think there could be capitulation here? After all, there were all the hypes on how one can make good money on 2x inverse ETFs. Did this lead some sheep into the slaughter house and now cannot endure the pain anymore? Remember Newton's law?

>SRS Chart

Historically, this is a good time to buy stocks. At the same time, I want to leave you another quote from Kung Fu Panda, “Yesterday is history, tomorrow is a mystery, but today is a gift. That is why it is called the present.”

Disclaimer: I own SRS at 54.50

Posted by

Unknown

at

6:35 PM

View Comments

![]()

![]()

Tuesday, December 16, 2008

My Twitter Notes

Reviewing my thoughts and notes from twitter.

I need to slow down and type better. WTF is this? Absolutely no sense.

Am I going to be lucky and is the Math degree going to pay off?

I didn't buy anything today, which means you should have.

Like I have said before, scared money don't win.

Sometimes, you just have to trust your instinct and put on noise cancelling headphones.

>FAS Chart OBV does not rise unless there are buyers.

Kung Fu Panda quotes, "There is no charge for awesomeness...or attractiveness."

Posted by

Unknown

at

6:45 PM

View Comments

![]()

![]()

Sunday, December 14, 2008

My Trading Rules

First, I major in Information Systems with minor in Math and Accounting.

This means I am a little anal when it comes to numbers, especially when they don't add up.

Rule #1 - I will post useful and not useless information.

Rule #2 - I will best try to post the price for the stock transaction so that there is a point of reference.

Rule #3 - My stops are not set in stone. I raise them to protect profit. I lower them to take more risk. Some times they work and some times they don't.

Why am I here? I am here to learn and to make more money. Hopefully, you can learn from my mistakes. Fade Me for a reason.

Posted by

Unknown

at

7:51 AM

View Comments

![]()

![]()

Saturday, December 13, 2008

Friday, December 12, 2008

Thursday, December 11, 2008

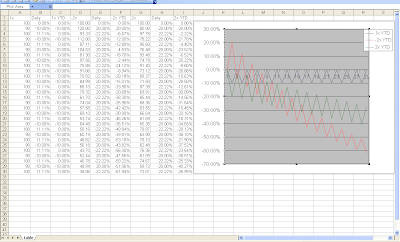

Timing and TimeFrame

When you follow a blogger or a post, you need to understand the timing and timeframe.

I posted >here that I was willing to buy OXY and I did at 48.

If the timing was a daytrade, then I would / should have been out. But it was more of a swing trade which I was willing to hold for a while and it turned out well.

>OXY

>Amazing Accuracy on SPX

>'Tis the Season to be Jolly?

If you have followed me long enough, you know that I will call a bullshit, "bullshit" and not anything else. I missed the down move today because I am still a little bullish bias and not being able to trade at work does not help either.

It's bad enough that brokers steal your money, but now, bloggers are trying to do it as well. Would you buy a car without testing driving it? Trust yourself and invest your time to learning and you will do well. Don't trust the bloggers out there (myself included) or trust but verify.

Posted by

Unknown

at

7:37 PM

View Comments

![]()

![]()

Friday, December 5, 2008

Time For The Major Indexes To Breakout

Time For The Major Indexes To Breakout

The November job report was horrendous. Nonfarm payroll dropped by 533,000 jobs, the largest drop since 1974, and the unemployment rate jumped to 6.7%. But once again, stocks were able to fight off the bad news. In the end, the bulls claimed victory for the day. The DJIA went from a triple digit loss in the morning to a triple digit gain at the close, up 259.18 points (+3.09%) to finish the week at 8635.42. The S&P 500 finished up 30.85 points (+3.65%) at 876.07 while the NASDAQ gained 63.75 points (+4.41%) at 1509.31.

The market internals totally turned around as prices reversed and finished in definitively positive territory. Advancers led decliners by a 7 to 3 ratio on the NYSE and by a 9 to 4 ratio on the NASDAQ. Volume expanded some from yesterday. About 85% of the volume was on the upside on both marketplaces. The financials (ETFs: XLF, UYG and FAS) were able to hold ground early in the morning backstopping the overall market from a larger decline in the face of the horrific employment data and provided leadership in the afternoon rally. The energy names which were the major drag in the DJIA in the morning were also able to turn around in the afternoon, adding strength to the afternoon rally.

Today's reversal on bad news suggests that “buying on the dip" is at work which should limit the downside risk in this market. VIX once again fell under its 50 day moving average suggesting a reduced fear level in the market. With a lighter week in terms of economic and corporate events, I expect bullish momentum to continue into next week. This doesn't mean that we won't see a pullback like what we had yesterday. Additionally, the major indexes still need to break above their respective resistance levels to change the longer trend to up.

Resistance for the DJIA is at 8831 (November 28 high) followed by 8985 (50 day moving average). Resistance for the S&P 500 is at 896 (November 28 high) followed by 916 (November 14 high) with 50 day moving average at 936. The NASDAQ broke above its 20 day moving average today and is now looking at the 1535 (November 28 high) resistance level followed by the 1596 level (November 13 high).

by Yin Lin, CFA

Significant Numbers To Watch

DJIA:

7449-Support, the 11/21/2008 low

9653-Resistance, the 11/04/2008 high

9033-50-day simple moving average

11263-200-day moving average

S&P 500:

741-Support, the 11/21/08 low

1007-Resistance, the 11/04/2008 high

942-50-day simple moving average

1224-200-day moving average

NASDAQ:

1295-Support, the 11/21/08 low

2200-Resistance, the 10/14/2008 high

1666-50-day simple moving average

2178-200-day moving average

Posted by

Unknown

at

7:22 PM

View Comments

![]()

![]()

Monday, December 1, 2008

Luck Favored the Prepared

First, a rant. It gets on my nerves when bloggers boast that they make 10k trading this week. Anyone with any math background will know that it's all about percentages. 10k trading with 500k equals 2% whereas 10k trading with 100k equals 10%.

I missed >SKF since I did not see the chart until Sunday night. Also, I thought it would fade and I thought wrong.

I can only find one stock I am willing to buy at the moment.

>OXY P&F

>OXY Candle

Posted by

Unknown

at

7:06 PM

View Comments

![]()

![]()